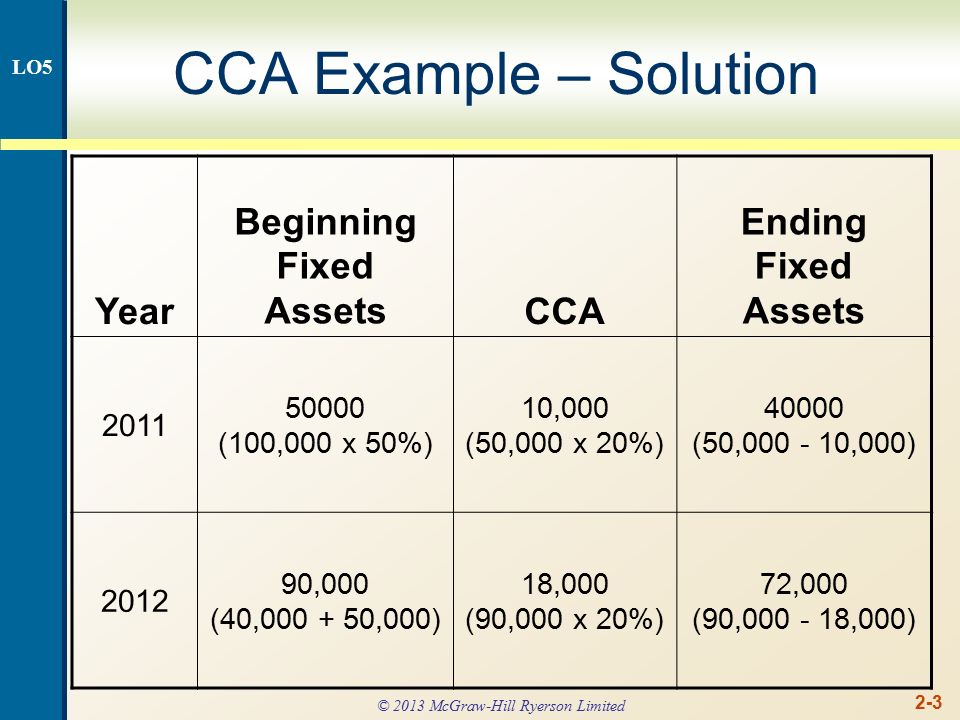

10-0 Capital Cost Allowance (CCA) CCA is depreciation for tax purposes The depreciation expense used for capital budgeting should be calculated according. - ppt download

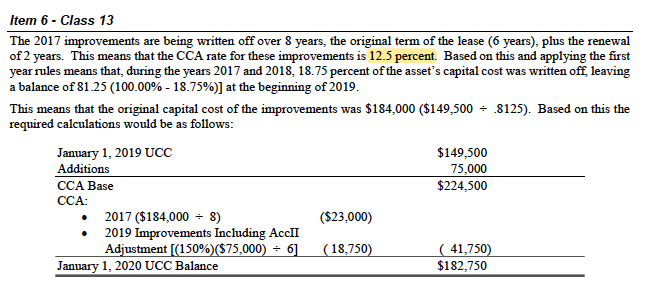

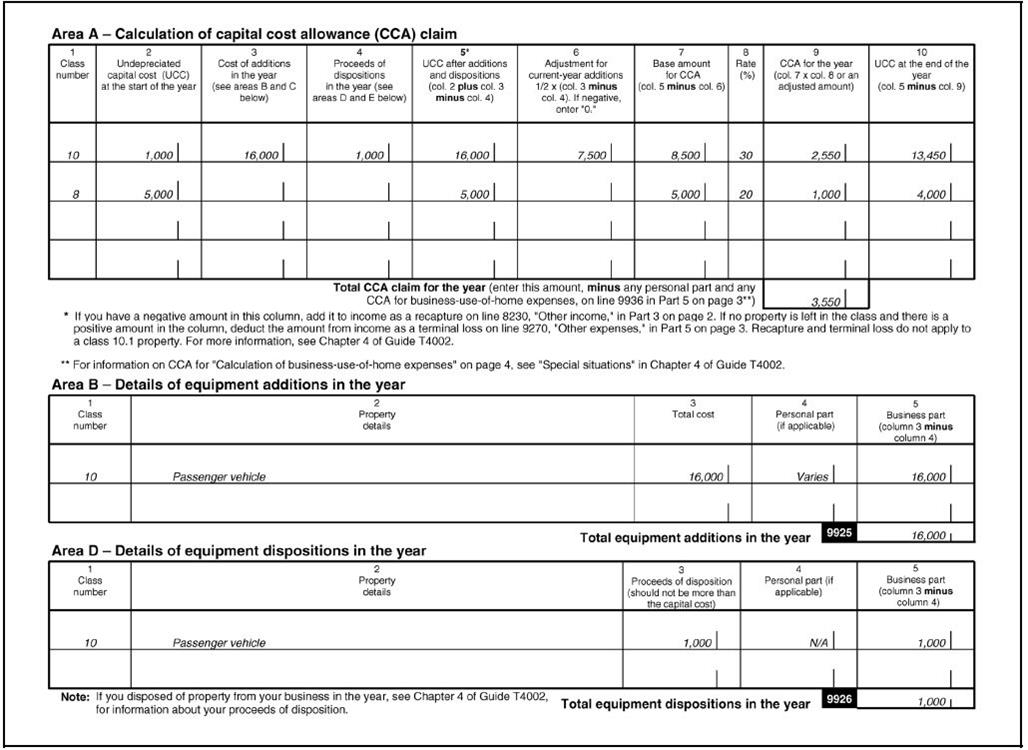

Knowledge Base Solution - Troubleshooting T12019-007 – Area A of Forms T2125, T2121, T2042, T1163, T1273, T776 and Resource – CCA other than classes 10.1 and 13 – Problem concerning the calculation

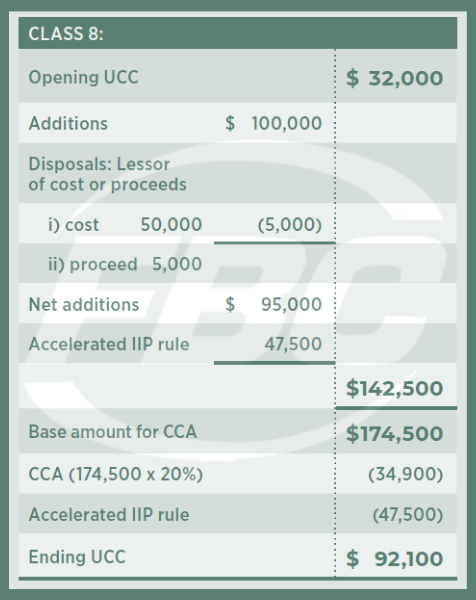

Knowledge Base Solution - Troubleshooting T22019-009 – Capital Cost Allowance (CCA) Workchart – Incorrect amount calculated on the line Capital cost of qualified property that became available for use in the current

3 October 2019 External T.I. 2018-0785371E5 - CCA calculation for Class 29 Property | Tax Interpretations

Fillable Online 2016 FARMING Calculation of Capital Cost Allowance (CCA) and Business-use-of-home Expenses Fax Email Print - pdfFiller

Knowledge Base Solution - Troubleshooting Memo T22020-005 – Capital Cost Allowance (CCA) Workchart – Incorrect calculation of the amount on line E used to calculate the additional CCA of 60% for Québec